As featured in:

Hello, and Welcome to Our Blog!

I’m Charles Scott, co-creator of FinancialChoicesMatter.com, and along with my co-creator Sheri Nordstom-Scott, I’m excited to share with you a bit of a different perspective on all things financial from our point of view.

I got into the financial planning and investment profession in 1982 and have seen a lot happen since then, much of it really exciting and some of it really scary.

We hope to bring you the most fun, interesting, and pertinent issues focused on helping and guiding you along your path of making intelligent and informed choices when it comes to all things “money”.

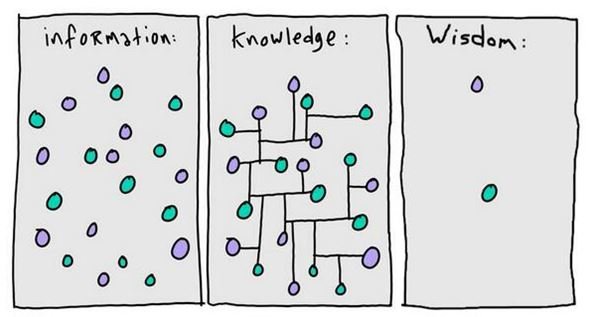

The image below pretty much sums up the current state of the world of money and finance.

Information is everywhere. 24/7/365. Data. Big data. You can’t get away from it. It certainly has the potential for overload, at least some of the time. But just because it exists doesn’t necessarily make it meaningful. There is so much more information available to everyone today than there was available to me when I started in the profession. WAY MORE!

That’s where knowledge begins to come into play. Understanding the information and when and where to use the information is the start of making sense of the world around us. It takes some time to develop this knowledge, to learn to differentiate, and to learn what is the most important information for the particular situation you are in at the time.

And wisdom marries the first two with experience. And for most of us, there is no substitute for experience. From this we hopefully arrive at the point where we can not only understand things for ourselves, but begin to impart that wisdom to help others and help them make good financial choices.

Which Life Stage Do You See Yourself In?

Growth Stage

The accumulation phase, when your primary goals are to provide for your family, enjoy a comfortable life, and invest sufficient savings to support yourself and possibly other family members in their later years.

![]()

Transition Stage

You’re old enough to start considering your retirement. You are contributing to your retirement accounts, IRA/Roth IRA/ 401(k), 403(b), etc. and are serious about taking actions to improve your financial future.

![]()

Maturity Stage

You are nearing, or are already in retirement. Your focus and goals are maintaining the lifestyle you’ve built and not running out of money, addressing health issue costs and inflation, and considering the transfer of wealth to younger generations.

![]()

Suddenly Single

Whether out of choice or circumstance, becoming suddenly single due to divorce or widowhood can cause your financial picture to tailspin. You’ve been forced to redefining who you are and what your financial future must look like now that you’re on your own.

Our Most Popular Articles

Here's a snippet of some of the goods. An yes, this is just the beginning.