How do you feel confident that you’ve choosing an advisor you can trust?

That’s a tough question because for most folks in your shoes, we all look the same.

We’re not the same from the norm in this industry. We are purposefully not the same.

There’s over thirty years of experience here, and we’ve pretty much seen in all – the good, the bad and the ugly. And we prefer the good.

Here is an outline that sums up the typical clients we work with. If this looks a bit like you, we would encourage you to contact us for a complementary initial conversation.

Absolutely no pressure. Let’s just see if you like us and we like you, and if we all think we might be able to help you. It’s just that simple. We like simple.

Who We Work With

I’ve been very fortunate to have a great group of clients for many years. While each client is unique, there are some common traits that might help you determine if you might benefit from our services.

Most clients are either retired or within 10 years of retirement.

They tend to see themselves as “conservative”. They are much more concerned with the return OF their money than the return ON their money. But they recognize the need for a reasonable return that enables them to maintain the lifestyle they prefer.

Our clients are patient, long-term investors committed to having a custom asset management plan included in their overall financial plan that works for the rest of their lives – not short-term trading that may or may not work.

Most clients are successful, family oriented, community involved people with life purposes that far exceed just money and personal belongings.

What Financial Planning is All About

First and foremost, it’s a process, not a one-time event. It requires action from both you and us.

Every client we have worked with over the years has a unique personal story, which we love hearing about, and yet they have many things in common.

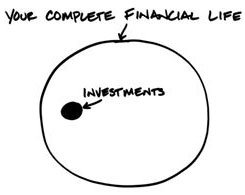

And we’re talking about financial planning here, not simply investment management, although that is an important piece of the overall picture.

I am a fee-based Accredited Investment Fiduciary™ and as such I have always acted in the best interest of my clients first and foremost in any and all recommendations I make.

That’s why I left the brokerage industry nearly 20 years ago because they would not allow me to act as a fiduciary. Owning my own investment advisory practice was what I needed to do so I could always do what is best for our clients.

That’s why Pelleton Capital Management, Ltd exists.

Every client receives a customized financial and investment management plan that is aligned with their unique financial goals and objectives.

As we mentioned above, this is a process and it starts here. We build these plans around anticipated life events such as retirement, wealth transfer issues, business succession planning, overall risk management, and asset protection.

While the majority of our clients are near or in retirement, we enjoy working with clients in every stage of their lives. You probably saw the four life stages on our home page, and we believe strongly that good financial planning is important at any age or stage of life and it’s our goal to help as many people as possible that are looking for honest, experienced, objective, and unbiased advice.

You could also read a bit more about our perspective surrounding inter-generational solutions on our investment website.

Our Communication With You

As you hopefully have seen from our blogging activities, I communicate regularly with clients via technology – email being the preferred communication method.

It is increasingly difficult for financial planners and investment advisors to actually perform their jobs if they are on the phone or in meetings all the time.

Because of this, we block off specific days and times to handle client meetings. The rest of our time is spent doing research and producing more valuable content that will benefit all of our clients.

If you’re the type of person that feels the need to talk frequently on the phone with their advisor, then we probably aren’t going to be a good fit for you.

It has been our experience that phone conversations without a clear, prearranged agenda of objectives is counter-productive to what my primary role is: helping our clients achieve their goals.

While most of our clients are here is Arizona or in Washington state, where we used to live, we do have clients scattered from coast to coast, so we can work virtually with those, using web conferencing technology and email to regularly communicate.

Working with a financial advisor without having to drive to their office is actually very easy and convenient. Meetings can be done from the comfort of your home or office while we still see each other over the computer screen while simultaneously being able to review financial matters.

Working with a financial advisor without having to drive to their office is actually very easy and convenient. Meetings can be done from the comfort of your home or office while we still see each other over the computer screen while simultaneously being able to review financial matters.

How We Get Paid For Our Services

At the risk of making this too complicated, let me say that we try to customize our fees to fit your situation. This is not a cookie-cutter approach, it’s what is going to work best for you?

Some clients simply want their investments managed for them and we charge a stated percentage of the assets we manage for you.

Some clients prefer that we include comprehensive financial planning for them.

Some want to pay a one-time fee for a plan and others prefer our monthly subscription model.

We’re flexible and would be happy give you a more detailed estimate of any costs when we’ve had an opportunity to find out a bit more about your specific situation and goals. You will always get complete disclosure of what you’re going to be paying for the services we provide. The last thing we want is for you to be unpleasantly surprised.

Most importantly I feel that clients and their advisors should get along and work as a team. Good financial planning and investment management don’t work overnight. It takes time, patience, and trust.

I’ve done the best I can at structuring my work and services in a manner that gives clients personal attention and financial management support. I know there is always room for improvement, and I strive to get better at what I do each day. My uncompromising promise is to take the hundreds and hundreds of hours of research I do each year and leverage it to benefit those who place their trust with me and my firm.

Could We Work Together?

After looking all of this over, if you’d like to have a conversation about working together, I’d be happy to invest a half hour to get to know you and your financial goals better, and see if there’s value I can provide in your life. All of these initial appointments are done via a phone call and/or web conference. To set up an initial meeting, have your questions answered, and to see if we could be a good fit – just use the “Schedule Appointment” button below.

Thanks for checking this out and learning more about who we serve and how we could work together.

Not quite ready to book an appointment? Don’t worry. Feel free to ask us any financial question and we’ll do our best to answer via email within 24-48 hours. As you might expect, we can’t guarantee we’ll be able to help everyone, but we try to get you the answers you’re after so you feel comfortable with whatever choices you may be looking to make. Reach out to us at charles@pelletoncapital.com.