It may be a sound investing strategy, but it loses power over time. For the last 18 months or so the investment markets have been up and down and up and down, and are now pretty much at the same levels they were 18 months ago…

Uncategorized

Global Bond Yields – Likely More Than You Really Want to Know

Many market observers have commented on the unusual mix of recently-rallying assets. Defying common wisdom, defensive assets (e.g., utilities, gold, and bonds) have rallied right alongside the more usual offensive sectors. Much debate about what this means has ensued – is the bond market predicting deflation? But wait, is gold predicting inflation? Are stocks giving […]

An Interesting Attempt to Predict the Future

I’m not sure why I’m blogging this, since nothing reliably predicts the future, but it seems like an interesting perspective. Attempts at forecasting future market returns over coming 10-year periods have mostly focused on measurements of market valuation. The well-known Cyclically-Adjusted Price-to-Earnings ratio (CAPE) is a prominent example. Another is Warren Buffett’s favorite: US stock […]

Quality vs. Value? Are We Being Way Too Picky Here?

Rob Arnott, the widely-followed financial guru and chairman of investing firm Research Affiliates, recently put out a rather striking research note exhorting investors to “dump quality stocks and buy value stocks”.

Why Don’t I Feel Better?

Much has been written in recent years along the lines of “if this is an expansion, why does it feel like we’re still in a recession?”

Oil

Finally, with oil selling at less than $30/barrel and the US’ major oil terminal at Cushing OK almost to full capacity, let’s revisit the “Peak Oil” scare of just a couple of decades ago.

Painful Technology

Last week’s overall market declines, bad as they were, masked a much worse development in the tech space. While the overall NASDAQ dove -3.25% on Friday, tech names such as LinkedIn and Tableau Software each plunged by over -40% – in a single day.

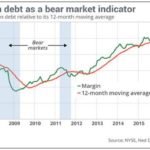

Does Margin Matter?

The famous saying that history doesn’t repeat itself, but it sure does rhyme may be at play here. Time will tell. One long-standing indicator of stock market health is the amount of money borrowed by investors and speculators for stock purchases – called “margin debt”.